Unlocking the Benefits of Your Home's Equity

Some Highlights

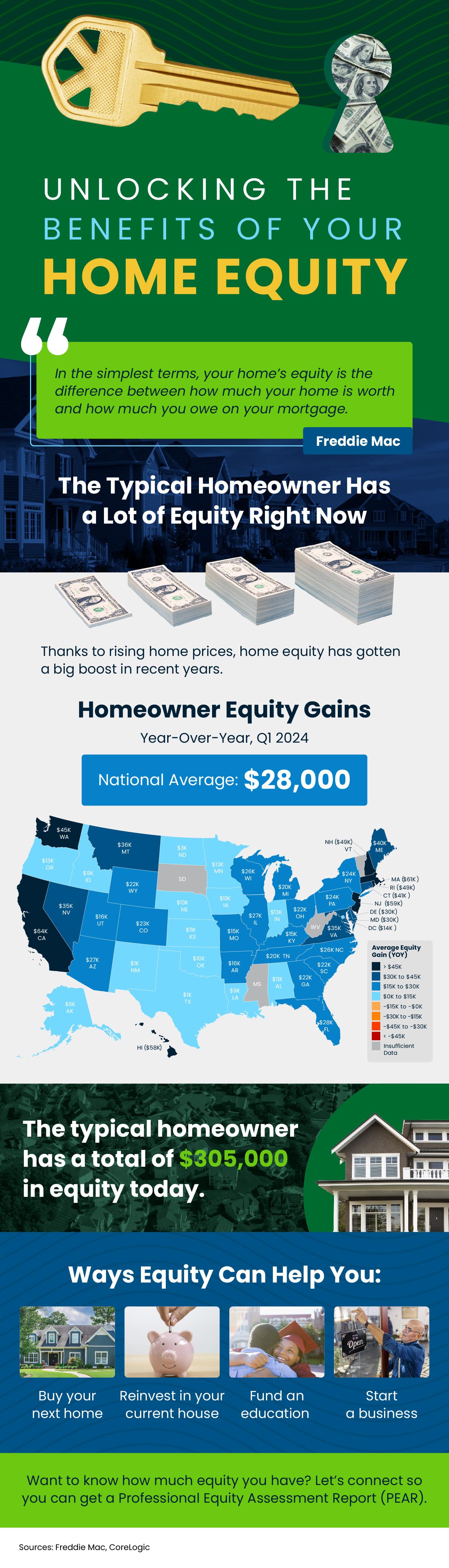

- Equity is the difference between what your house is worth and what you still owe on your mortgage.

- The typical homeowner gained $28,000 over the past year and has a grand total of $305,000 in equity. And there are a lot of great ways you can use that equity.

- To find out how much equity you have, connect with a real estate agent who can give you a Professional Equity Assessment Report (PEAR).

Categories

Recent Posts

2025 Housing Market Forecasts

One Homebuying Step You Don’t Want To Skip: Pre-Approval

Roughly 11,000 Homes Will Sell Today – Will Yours Be One of Them?

The Truth About Credit Scores and Buying a Home

How Much Home Equity Have You Gained? The Answer Might Surprise You

How Mortgage Rates Affect Your Monthly Payment

What To Save for When Buying a Home

Mortgage Forbearance: A Helpful Option for Homeowners Facing Challenges

Expert Forecasts for the 2025 Housing Market

Time in the Market Beats Timing the Market

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "